Born to support the growth and competitiveness of Italy's industry

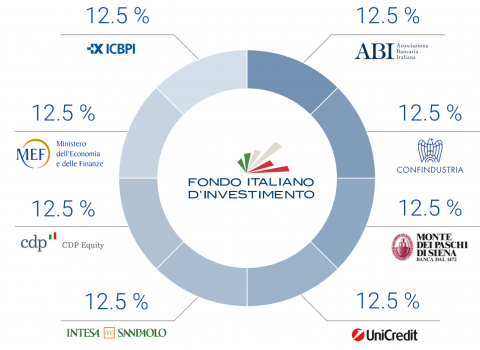

Our story began in 2010, when the Italian Ministry of Economy and Finance brought together Italy's leading financial players to create the largest private equity fund dedicated to boosting the competitiveness of small- and medium-sized Italian enterprises.

It is the story of a mission that we have been pursuing since 2010.

18 March 2010

The Italian Ministry of Economy and Finance, together with some of Italy's leading banks and institutions, set up Fondo Italiano d’Investimento SGR to support the growth of businesses throughout their life cycle and promote the development of Italy's industry.

The Fund set out 3 key objectives:

- Earning a return on the invested capital

- Supporting the growth of small-and medium-sized Italian enterprises

- Supporting the development of the italian private capital

21 December 2010

Fondo Italiano's first fund, named Fondo Italiano di Investimento—initially dedicated to both direct and fund-of-funds investments—became operational and raised €1.2 billion at its initial closing.

In December 2010, the Fund made its first investment in Arioli S.p.A., a world-class manufacturer and seller of high-end textile finishing machinery.

In the years from 2012 to 2014, Fondo Italiano consolidated its core investment areas and launched other initiatives.

2014 saw the launch of the second Venture Capital fund of funds, named "FOF Venture Capital", and the first Private Debt fund of funds "FOF Private Debt".

In 2016, the first fund was divided into three entities: Fondo Italiano di Investimento(FII Uno), for direct investments; Fondo Italiano di Investimento - Fondo di Fondi (FOF PE), indirect private equity investments; Fondo Italiano di Investimento - FII Venture, for indirect venture capital investments.

2017

2017 saw the expansion of direct private equity investments with the launch of “Fondo Italiano Tecnologia e Crescita – FITEC”, and “Fondo Italiano Consolidamento e Crescita – FICC”.

In the same year, the Fund set out on a journey to make sustainability a strategic issue within the scope of its organisation and investing activities, adopting the Responsible Finance Policy.

2019

In 2019, the Fund published its First Sustainability Report after further strengthening its commitment to sustainability topics, as shown also by its signing on to the United Nations Principles for Responsible Investments (UN PRI).

The same year saw the launch of “Fondo Italiano Tecnologia e Crescita Lazio – FITEC Lazio”, FITEC's parallel fund dedicated to investing in the Lazio region, and Fondo di Fondi Private Equity Italia, dedicated to investments in Italy's real economy to support SMEs.

Over its 10 years of existence, FII has been supporting the reference market and developing a robust track record by gradually growing its operations organically.

2020 began with the launch of the second private debt fund of funds, “FOF Private Debt Italia”, dedicated to supporting Italy's real economy.

In addition, in 2020 Fondo Italiano d’Investimento approved “Forward 2023”, the new 2020-2023 Business Plan that marks the beginning of its phase 2.