Serving businesses to make Italy more competitive

About us

We have been operating since 2010 to promote the competitiveness of Italy's industrial system, supporting the growth of Italian businesses and contributing to the growth of the country's real economy.

With over 600 Firms in our Portfolio, we are currently Italy's largest institutional investor in private capital.

Managed funds

Companies involved

The largest institutional investor supporting Italy's real economy

Investment approach and strategy

Investing for the long term

We invest with a strategic, long-term outlook, supporting world-class SMEs operating in supply chains that are strategic to Italy: our goal is to give the country more competitive, more technologically advanced, and more resilient industrial supply chains.

We provide businesses with “patient” capital to create lasting value over the medium-long term.

We operate in high-growth potential sectors that contribute the most to Italy's GDP.

We promote Italy's sustainable growth by integrating ESG factors into our investment process.

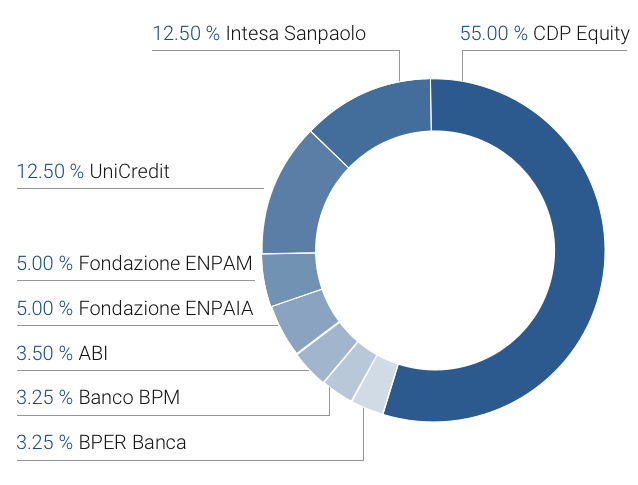

Ownership structure

A unique public-private network to support the recapitalisation of small- and medium-sized Italian enterprises.

Created on the initiative of the Italian Ministry of Economy and Finance, Fondo Italiano d’Investimento is owned by CDP Equity, Intesa Sanpaolo, UniCredit, Fondazione ENPAM, Fondazione ENPAIA, ABI – Associazione Bancaria Italia, Banco BPM and BPER Banca.